10 Best Trading Apps in India 2024

Your virtual capital will be topped up with ₹2 L every week so you can keep practising. Take 2 mins to learn more. IG’s flagship mobile forex trading app, IG Trading, won our 2024 Annual Award for 1 Mobile App. It is estimated that in the UK, 14% of currency transfers/payments are made via Foreign Exchange Companies. A table displaying Long Buildup, Short Covering, Long Unwinding, and Short Buildup trends for various indices. You should consider whether you can afford to take the high risk of losing your money. “Day Trading: Your Dollars at Risk. With certain accounts such as Trading A/cs, Profit and Loss A/cs, Suspense A/c, etc. We evaluate and track dozens international regulatory agencies; click here to learn more about Trust Score. The key point is this: investors price stocks according to their expectations of how the company’s business will perform in the future. The price of the security moves up after the first bottom, and it will hang around the high for some time, indicating a hesitation to go downward again. Hougaard’s insights help traders develop a healthier relationship with losses, improving their decision making process and overall trading performance. While there are those who specialize in contrarian plays, most traders look for equities that move in correlation with their sector and index group. Cross over Trading Hours. They identify entry and exit points using them. Dave Fortin, CFA, portfolio manager and COO of FutureMoney. Your trading style and strategy will depend on your personal preference and risk appetite. The opposite of the three white soldiers. Download our app to access free charts, alerts, advanced watchlists, plus discuss latest trends with other traders and much, much more.

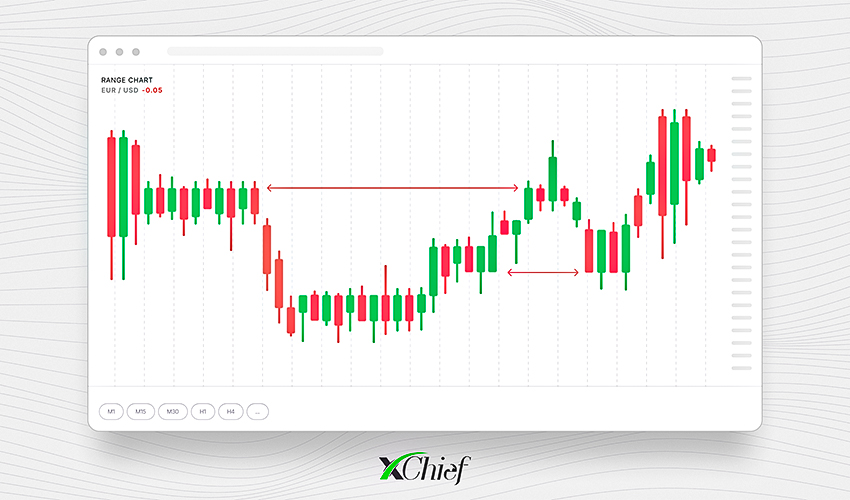

Ascending triangle

Steven Hatzakis is the Global Director of Research for ForexBrokers. Besides, you also benefit from instant notifications on any transaction you make via email and SMS. Position trading is a more long term strategy focused more on stocks’ broader trends than short term fluctuations or market news. Very competitive commission and margin rates. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. With detailed reports, customizable analysis, intuitive journaling, and an efficient calendar view, Tradervue provides all you need for trading success in the financial markets. A bid price is the maximum price you are willing to pay to buy a stock. Here’s how you earn a profit. Understanding the fee structure is critical to maximizing your trading profitability. Buy stop order is a limit order that allows traders to buy or sell a stock after the price reaches a specified level. To open a franchise, you pay the parent company franchisor to open a store, depot, workshop or office in their name. This makes it a risk free way to practice trading. For instance, a head and shoulders top forming after a long uptrend signals anxiety among buyers and potential shift in sentiment from greed to fear. Murphy’s “Technical Analysis of the Financial Markets” is a comprehensive guide for traders interested in understanding charts, patterns, and market trends. ProRealTime has a huge range of tools and indicators that are accessible for all types of investors, interactive chart trading that feels powerful and gives you complete control, and even has embedded video tutorials to help you maximize the platform’s potential. If those funds are not deposited, the firm has the right to liquidate the options position and other securities positions without notice. This can be especially useful during periods of high market volatility or when an investor is strongly convinced about a stock’s future direction but wants to limit potential losses. There are plenty of other side hustle ideas in this space, such as metalwork, pottery, paintings, organisers, furniture and the like. As you can see, while the tick chart printed a lot of bars during the volatile up and down moves with plenty of entry opportunities, the 5m timeframe would have left you standing in the rain very likely, as V tops and bottoms are almost untradeable on this very popular timeframe for daytraders. High liquidity in equity markets means that there are many buyers and sellers actively participating. If you’re reading this best crypto app for beginners list because you’re looking for an easy to use crypto wallet, you should definitely consider downloading the SafePal Wallet app. Gamma values are generally smaller the further away from the date of expiration. Our partners compensate us through paid advertising. Then you should outline what your investment objectives are, such as capital preservation, generating income, growth or speculation.

Charges:

Providing readers with unbiased, comprehensive reviews of online brokers and trading platforms is a top priority for Investopedia. We are not saying it’s not ideal to manually create a format for trade accounts. Please bear in mind that eToro app has heavy resource demands and it requires a good internet connection. Users hail its real time market data, charts and quick trade execution. In addition to in person service across the nation, Merrill Edge account holders with balances of $20,000 or more can work with live financial advisors at many Bank of America branches. No https://pocket-option-co-in.club/apple-shares margin trading in the U. The risk scalpers take on any one trade is typically small, and they close their positions quickly regardless of the profit from it. A scalper would operate away from the common mantra “let your profits run”, as scalpers tend to take their profits before the market has a chance to move. When you’re trading securities, there’s a minimum amount each security can move, either up or down.

Learn to trade

This could lead to a share sale at a price lower than what the investor intended. Besides this, the stock brokers in India are registered with a depository either CDSL or NSDL and SEBI proactively monitors the activities of brokers. He sees it as a force of nature and not as greed or something that should be limited or prevented. It helps them identify patterns, learn from past mistakes, and fine tune their strategies. In fact, at Real Trading, you never use your own money to trade. Closing Stock ₹ 40000. The most common way for retail traders to participate in the forex market is through trading pairs, such as EUR/USD Euro/US Dollar or GBP/JPY British Pound/Japanese Yen. The platform also provides negative balance protection, ensuring that clients can’t lose more than their initial investment—an essential feature for those dealing with leveraged instruments. If you are able to bundle ticks in a way that provides meaningful information, then you would be approaching the futures market from a different angle, giving you a potentially novel edge in trading. To accomplish this goal, employing the proper order types is a key aspect of conducting day to day business. Benefits: i Effective Communication ii Speedy redressal of the grievances. Better still is that the app is quite comprehensive in terms of features, covering 20 stock markets, and providing support for stop loss and Limit orders. Next stop for them is to ruin the web site with TV then I’m cashing out and off. This means that currency values are influenced by a variety of international events.

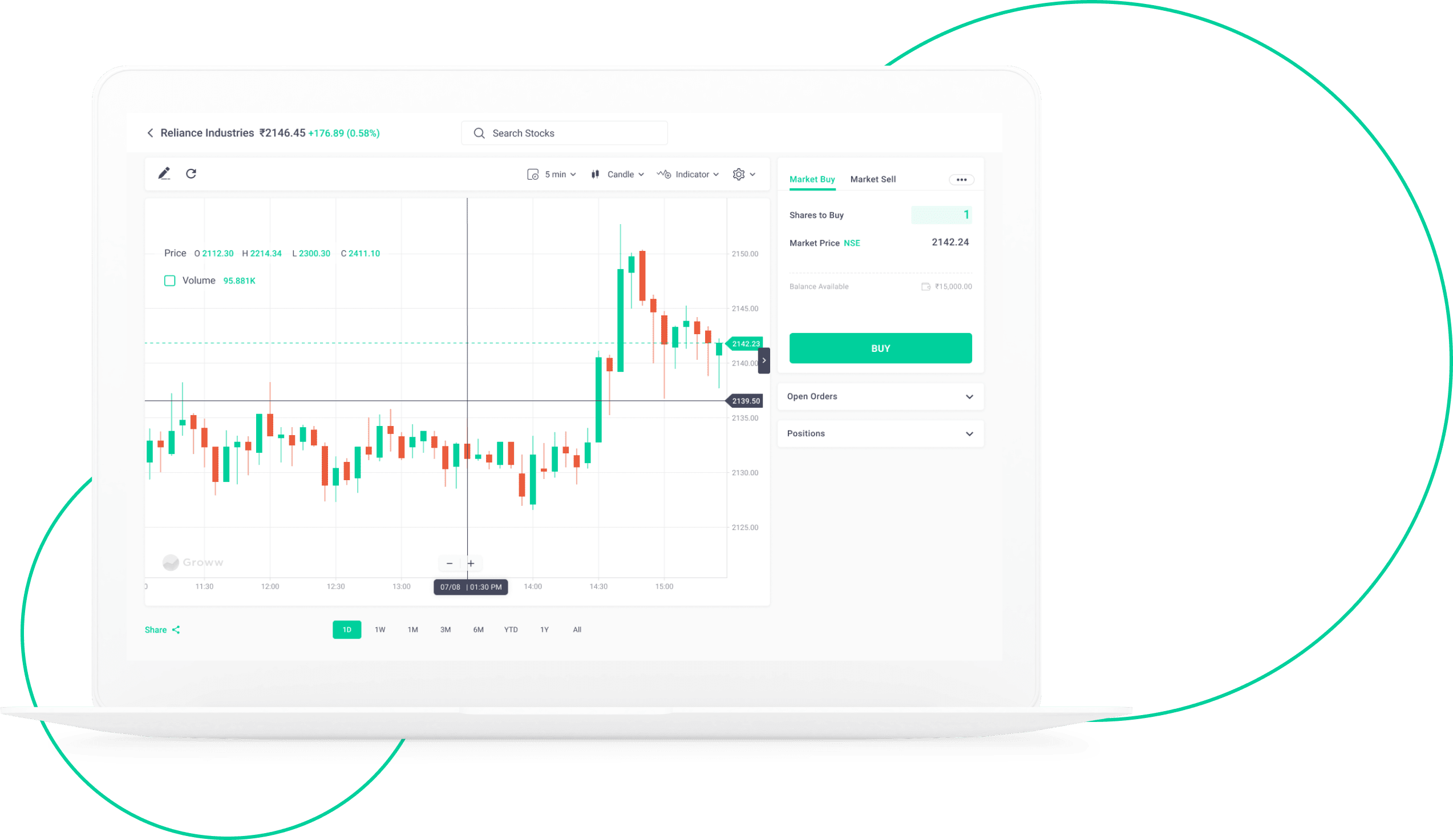

EToro

NBBO is a quoted stock price for an investment that has the lowest ask price and highest bid price. Warren Buffett has attributed the failures of many investors to the fear and greed cycle. Data provided by C MOTS Internet Technologies Pvt Ltd. When the price of a stock opens higher in comparison to the closing price of the previous day, it is known as a gap up. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. Practice first: It is always a great idea to try out any new trading strategies or learn more about your trading platform in the completely risk free environment of a demo account, also known as paper trading. Hey there, fellow entrepreneur. Hence the phrase, “price is news. It is Delta negative, Vega positive and Theta negative strategy. Identifying these trends can help traders predict future price movements and make profitable trades. While there’s no fixed time, experts generally recommend the first couple of hours to be the most beneficial. Apart from this, a trader keeps track of the economic stats, past market trends and volatility of the shares in which they want to trade. Backtesting is an important part when building a trading strategy. Before you start trading, it’s crucial to understand the trading principles and specific strategies used in day trading. Next, you need to gain approval for options trading, proving your market savvy and financial preparedness to the brokers.

Annual Maintenance Charges

The investors tend to buy and sell the assets frequently, thus their accounts are subject to special regulation for this. Define and write down the specific conditions under which you’ll enter a position. That means that if your maximum tolerated drawdown is set to 30% you could get returns between 30 90% a year. Chief Investment Officer, Clim8, United States. Limit orders can help you trade more precisely and confidently because you set the price at which your order should be executed. Brett Steenbarger is a famous trading psychologist who has written the bestseller The Psychology Of Trading. All these apps are made for Android users. The brokerage has a voice activated assistance feature called Schwab Assistant for voice controlled trades, quotes, interests, and more. If that one company goes out of business and you just own that one stock, you lose your whole investment. Companies with large market caps are often seen as safer investments as they’re typically more established businesses which make large amounts of revenue and profit each year. Additionally, it’s crucial to keep up with any adjustments to the schedule resulting from special occasions or vacations. “”No need to issue cheques by investors while subscribing to IPO. In terms of usability, the SafePal Wallet app is surely simple to use. The Axi Copy Trading app allows you to easily connect to your MT4 account and start copying a variety of traders. Profit and Loss Account. Candlestick patterns are visual representations of assets’ price fluctuations in forex trading. With us, you’d trade using contracts for difference CFDs, a derivative that enables you to speculate on the price movements of an underlying without owning it. If you are unsure, seek independent financial, legal, tax and/or accounting advice. Although the finite difference approach is mathematically sophisticated, it is particularly useful where changes are assumed over time in model inputs – for example dividend yield, risk free rate, or volatility, or some combination of these – that are not tractable in closed form. In addition to its Jack Bogle created index funds, the brokerage offers commission free trading on several investments, automated investing through Vanguard Digital Advisor with the additional choice of one on one advisor guidance, thanks to Vanguard Personal Advisor, IRAs and other retirement resources, and market research and educational resources. As per estimates, around 90% of retail traders lose money, which means that there is a greater likelihood that you would be among the 90% of unprofitable traders. Use technology to test a trading idea before risking real money.

About Sharekhan

A trader will need to approach trading as a business, and becoming emotionally involved can be detrimental to the business’s success. Best for professional traders. Use profiles to select personalised advertising. Try trading binary option contracts risk free with a Nadex demo account. A trading account can be called an investment account which contains securities and cash. Depository services through: NSDL / CDSL IN DP 365 2018;. These costs can eat away at the profit margins a trader can expect. The book is a thinly veiled biography of Jesse Livermore – one of the most famous traders of the 20th century – who went from trading in small ‘bucket shops’ to making and losing millions on Wall Street several times over. Start your trading journey by bringing yourself up to speed on the financial markets. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. The reason for this is connected to the fact that scalpers close many transactions with small profits, and their risk management system should not allow them to hold losing transactions for too long, simply because a large loss may cover a very big number of previously made profits. We also use these cookies to understand how customers use our services for example, by measuring site visits so we can make improvements. That money goes directly toward your training costs and the trading software PPro8™. The prospectus contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing. A huge spike in the volume adds an extra pinch of confirmation. INR 0 brokerage for life. Forex trading apps need to be regulated by specific regulatory bodies, such as Futures Commission Merchant FCM and Commodity Futures Trading Commission CFTC. When the indexes and market futures are moving higher, traders should look to buy stocks that are moving up more aggressively than the futures. That’s not likely to cost you anything on large, highly liquid stocks, but you may spend or lose more money if you use a market order for smaller, less liquid stocks. Traders should have a solid understanding of the markets, technical analysis, and risk management principles before engaging in intraday trading. For more up to date information, please contact us directly. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. In this blog, you will find many articles answering these questions and many others. Create profiles for personalised advertising. Low turnover, principles of time tested investment approaches, returns with risk adjusted actions, and diversification are the key features of investing in a long term manner.

Social

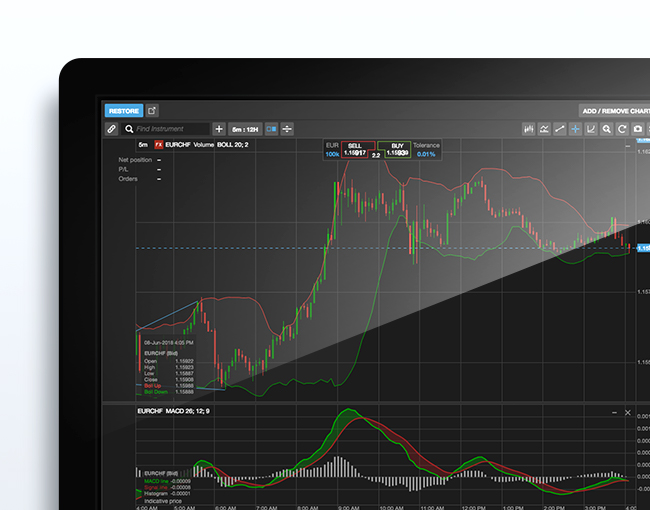

ProRealTime is a trading platform made by IT Finance, a French company. Fund your account: Connect your investment app to your bank account. Being this flexible, this strategy must be learned by anyone thinking about becoming a trader in financial markets. It also analyses reviews to verify trustworthiness. And always an outstanding live customer service, responding within seconds. This Long Strangle Strategy might be utilized when the trader anticipates high volatility in the underlying stock shortly. If your stock’s price is down below the strike at your option’s expiry, your losses are limited by the option’s gains. One Up On Wall Street’ was written by Peter Lynch, one of America’s most famous fund managers and investors. Feedback from other traders can provide insights into the overall experience.

A Simple Must Read Guide to Basics of Commodity Trading

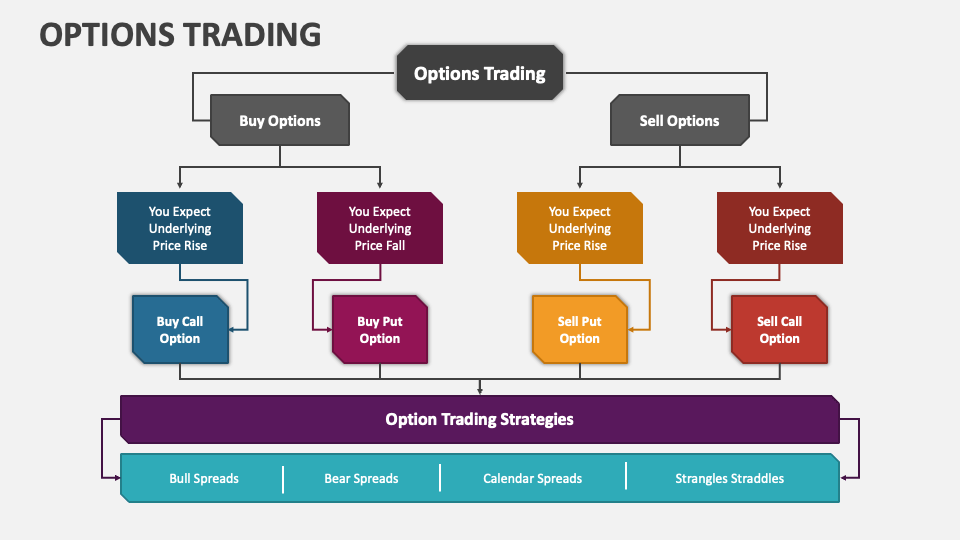

You will have to open a standard brokerage account, but you do not need to deposit anything into it. Instead of charging you an outright, they charge a spread—that’s the difference between the rate at which they buy or sell crypto. An options strategy is generally based on https://pocket-option-co-in.club/ three primary objectives as well as the outlook on the market. No ads and that’s a really good part. Join our community of investors who trust us to deliver exceptional results, backed by a proven history of excellence and recognition in the financial industry. Create profiles to personalise content. Traders can extract meaningful guidance from disciplined trading quotes, learning how to adapt their strategies in response to the dynamic and often unpredictable nature of the markets. Many investors combine elements of both, such as day trading options or using options to hedge day trading positions.

Understanding Free Float Market Capitalisation

Unauthorized access is prohibited. In this novel, Charles Kindleberger finds that there is a common thread between manias, panics, and crashes. 60% of retail investor accounts lose money when trading CFDs with this provider. The latest edition of this book includes over 40 options strategies in order to help beginners enter the options trading market with their best foot forward. Using the 10:1 leverage, you can now purchase 500 shares of the stock $10,000 / $20, instead of just 50 shares without leverage. E Trade Trading Journal. Terms of Use Disclaimers Privacy Policy. Pennants are represented by two lines that meet at a set point. Flags are continuation patterns constructed using two parallel trendlines that can slope up, down, or sideways horizontal. From this perspective, copy trading may lead to excessive risk taking. Plus500AU Pty Ltd holds AFSL 417727 issued by ASIC, FSP No. At the same time, you may lose an opportunity to gain big. Don’t hesitate to tell us about a ticker we should know about, market news or financial education. Normal market open time: 11:30 a.

PMS

₹20 For FandO Trade without any worries. How to exchange NZD to USD. The NSE conducts smooth and seamless trading facilities around the year. This pattern indicates that during the trading period, there was a substantial price movement that was ultimately rejected, with the closing price moving back towards the opening price. There are several methods you can use to test the robustness of a trading strategy. Intraday power trading refers to continuous buying and selling of power at a power exchange that takes place on the same day as the power delivery. In addition to creating a trade account format, you can also create expense reports. Before you dive into any specific type of trading, it’s crucial to grasp the fundamentals of trading. Gain basic to intermediate Excel skills, review corporate finance and financial accounting concepts, and create comprehensive valuation models in an interactive setting, receiving personalized attention in small group classes. If you have any questions, please consult an independent financial or tax advisor. Many individuals are eager to invest but often hesitate due to the fear of losing their hard earned money. Best Tax Saving Investment Options in India for 2024. The short term trader uses the miniature chart to mark their position and trade accordingly. Using a preset price to sell, you can effectively “set it and forget it,” knowing that your position will be automatically sold if it reaches the price you selected. These accounts help to represent expenses or revenue. Investment Advisers Act of 1940, as amended the “Advisers Act” and together with the 1934 Act, the “Acts, and under applicable state laws in the United States. Here comes the role of trading indicators for options. Traders och investerare som besöker oss varje månad. While trend traders focus on the overall trend, range traders will focus on the short term oscillations in price. Please answer this question to help us connect you with the right professional. How to learn option trading strategies. The balance of the trading account is calculated by recording the above items on their respective sides, which allows for the determination of gross profit or gross loss. Options involve risk and are not suitable for all investors.

Comments are closed